Procure-to-Pay (P2P) software is revolutionizing the way businesses handle their procurement and financial operations. This integrated solution streamlines the entire procurement process, from initial purchase requisition to payment, offering a myriad of benefits that can significantly impact a company’s bottom line. Let’s delve into the advantages of P2P software and understand why it’s becoming an indispensable tool for modern businesses.

Understanding Procure-to-Pay Software

Procure-to-Pay software automates and integrates the processes of purchasing goods and services and managing their payment. It covers the entire procurement cycle, including requisition, purchase order creation, receipt of goods, invoice processing, and payment to suppliers. This comprehensive approach ensures a seamless, efficient, and transparent workflow, reducing manual tasks and minimizing errors.

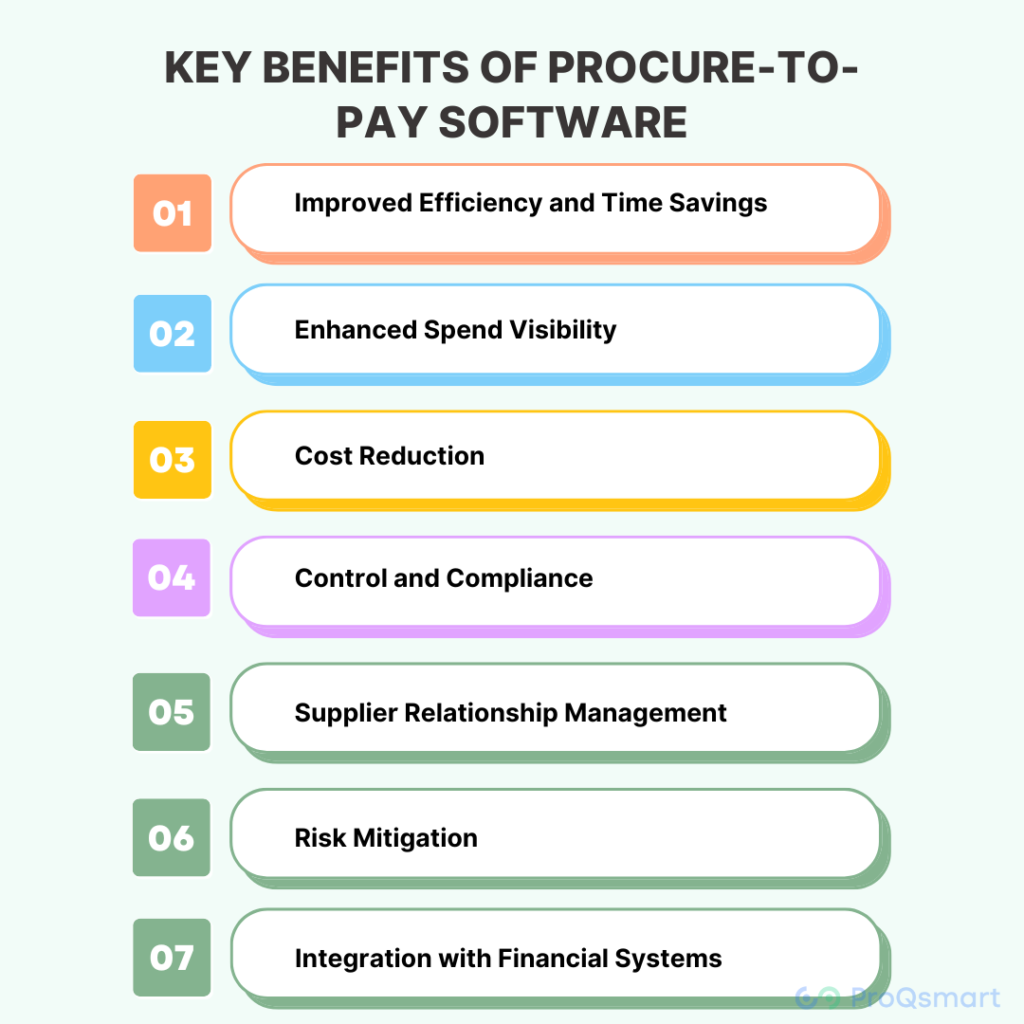

Key Benefits of Procure-to-Pay Software

Improved Efficiency and Time Savings

Automation of routine procurement tasks reduces manual data entry and paperwork, speeding up the procurement process and freeing up staff to focus on strategic tasks.

Enhanced Spend Visibility

P2P software provides real-time insights into spending patterns, enabling better budget management and strategic decision-making.

Cost Reduction

By streamlining procurement processes and improving contract compliance, P2P software helps organizations negotiate better terms and take advantage of early payment discounts, thus reducing overall costs. Learn strategies and manage spend.

Control and Compliance

The software enforces procurement policies and approval workflows, ensuring that all transactions comply with company policies and regulatory requirements.

Supplier Relationship Management

Effective management of supplier information, performance, and relationships is facilitated through centralized data and streamlined communication channels.:

Risk Mitigation

Enhanced transparency and control help in identifying and managing risks in the procurement process, reducing the likelihood of fraud and errors.

Integration with Financial Systems

P2P software integrates seamlessly with existing ERP (Enterprise Resource Planning) systems, ensuring a unified view of financial data and simplifying the reconciliation process.

Implementing Procure-to-Pay Software

To fully realize the benefits of P2P software, organizations should carefully plan and execute its implementation. This includes assessing current procurement processes, selecting software that aligns with organizational needs, and training employees to use the new system effectively. Successful implementation requires collaboration across departments to ensure that the software integrates smoothly with existing processes and meets the unique needs of the business.

Case Studies and Real-Life Examples

Many companies across various industries have seen significant improvements in procurement efficiency and cost savings after implementing P2P software. For instance, a manufacturing firm may reduce procurement cycle times by 50% and achieve a 30% reduction in procurement costs, illustrating the substantial impact of P2P solutions.

Conclusion

The benefits of Procure-to-Pay software are clear and compelling. By automating procurement processes, enhancing visibility into spending, improving compliance, and fostering better supplier relationships, P2P software can transform a company’s procurement function into a strategic asset. As businesses continue to seek ways to optimize operations and reduce costs, the adoption of Procure-to-Pay solutions is set to rise, marking a new era in procurement and financial management.

FAQs

Who typically uses Procure-to-Pay software within an organization?

Procure-to-Pay software is used by various departments within an organization, including procurement, finance, accounts payable, and sometimes by departmental heads or managers responsible for approving purchases and expenses.

Can Procure-to-Pay software be customized to fit specific business needs?

Yes, most Procure-to-Pay software solutions offer customizable features and workflows to fit the specific needs and requirements of different businesses, ensuring that the software can adapt to various procurement processes and policies.

How does Procure-to-Pay software integrate with other business systems?

Procure-to-Pay software typically integrates with a range of business systems, including ERP (Enterprise Resource Planning), financial accounting, inventory management, and CRM (Customer Relationship Management) systems, providing a seamless flow of data across the organization.

What are the typical steps involved in the Procure-to-Pay process?

The typical steps in the Procure-to-Pay process include requisition creation, requisition approval, purchase order generation, receipt of goods or services, invoice matching and approval, and payment processing.

How does Procure-to-Pay software support regulatory compliance?

- Procure-to-Pay software supports regulatory compliance by enforcing standardized procedures, maintaining detailed audit trails, ensuring data accuracy, and facilitating reporting requirements, which help organizations adhere to financial and procurement regulations.

Leave a Reply